The recently passed American Rescue Plan (ARP) Act of 2021 includes a provision making nearly all student loan forgiveness tax-free, at least temporarily. Before the ARP, student loan forgiveness was tax-free only under special programs. Before we look at the changes to come under the ARP, let’s look back at what the previous law provided. […]

read more

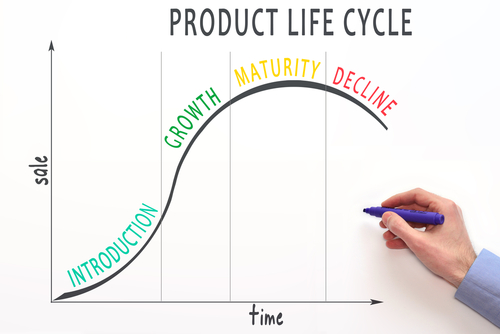

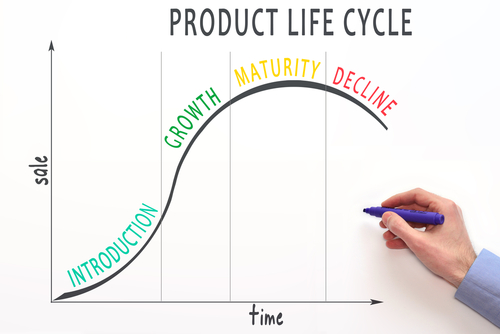

The majority of U.S. industrial product company CFOs have shared concerns that COVID-19 would impact their businesses negatively. For companies that develop and manufacture products, understanding the product lifecycle and how to work around crises like the COVID-19 pandemic can be effective to help improve the longevity and success of companies. Market Development Stage According […]

read more

In 2020, a year when all income brackets benefited from lower tax rates, the stock market took a nosedive at the beginning of the pandemic. For investors sharp enough to see the opportunity, this was an ideal time to convert a traditional IRA into a Roth IRA. When you conduct a Roth conversion, the assets […]

read more

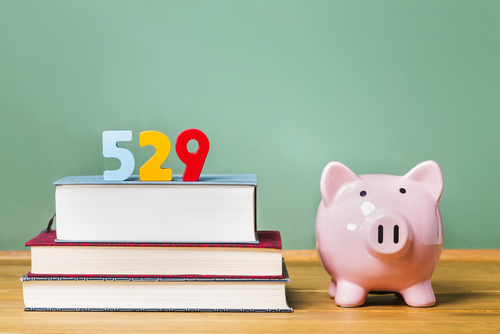

What if you could save enough for your child to go to college debt-free? It might sound impossible, but with dedication, hard work, and careful planning, you can do just that. According to Dave Ramsey, American personal finance advisor, here are the top three tax-favored plans to get started. The Education Savings Account (ESA) Otherwise […]

read more

The recently passed American Rescue Plan (ARP) Act of 2021 includes a provision making nearly all student loan forgiveness tax-free, at least temporarily. Before the ARP, student loan forgiveness was tax-free only under special programs. Before we look at the changes to come under the ARP, let’s look back at what the previous law provided. […]

read more

The recently passed American Rescue Plan (ARP) Act of 2021 includes a provision making nearly all student loan forgiveness tax-free, at least temporarily. Before the ARP, student loan forgiveness was tax-free only under special programs. Before we look at the changes to come under the ARP, let’s look back at what the previous law provided. […]

read more

The majority of U.S. industrial product company CFOs have shared concerns that COVID-19 would impact their businesses negatively. For companies that develop and manufacture products, understanding the product lifecycle and how to work around crises like the COVID-19 pandemic can be effective to help improve the longevity and success of companies. Market Development Stage According […]

read more

The majority of U.S. industrial product company CFOs have shared concerns that COVID-19 would impact their businesses negatively. For companies that develop and manufacture products, understanding the product lifecycle and how to work around crises like the COVID-19 pandemic can be effective to help improve the longevity and success of companies. Market Development Stage According […]

read more

In 2020, a year when all income brackets benefited from lower tax rates, the stock market took a nosedive at the beginning of the pandemic. For investors sharp enough to see the opportunity, this was an ideal time to convert a traditional IRA into a Roth IRA. When you conduct a Roth conversion, the assets […]

read more

In 2020, a year when all income brackets benefited from lower tax rates, the stock market took a nosedive at the beginning of the pandemic. For investors sharp enough to see the opportunity, this was an ideal time to convert a traditional IRA into a Roth IRA. When you conduct a Roth conversion, the assets […]

read more

What if you could save enough for your child to go to college debt-free? It might sound impossible, but with dedication, hard work, and careful planning, you can do just that. According to Dave Ramsey, American personal finance advisor, here are the top three tax-favored plans to get started. The Education Savings Account (ESA) Otherwise […]

read more

What if you could save enough for your child to go to college debt-free? It might sound impossible, but with dedication, hard work, and careful planning, you can do just that. According to Dave Ramsey, American personal finance advisor, here are the top three tax-favored plans to get started. The Education Savings Account (ESA) Otherwise […]

read more