News

Read the latest updates here!

Real Estate Opportunities in 2021 - Jun. 01, 2021

Even before the pandemic began, the U.S. residential real estate market was short on houses, with more people looking to buy than those who were selling. And yet, unlike the 2008 recession, any economic woes related to the pandemic did not undercut housing prices. If anything, real estate had a banner year as home prices […]

read more

Even before the pandemic began, the U.S. residential real estate market was short on houses, with more people looking to buy than those who were selling. And yet, unlike the 2008 recession, any economic woes related to the pandemic did not undercut housing prices. If anything, real estate had a banner year as home prices […]

read more

6 Ways to Make Saving Money Fun - Jun. 01, 2021

Let’s face it. Saving money is a challenge at best – and really hard the rest of the time. But what if you made it a fun game to inspire yourself to save? Here are a few ways to do just that. Keep the Change Challenge Anytime you receive or find loose change in your […]

read more

Let’s face it. Saving money is a challenge at best – and really hard the rest of the time. But what if you made it a fun game to inspire yourself to save? Here are a few ways to do just that. Keep the Change Challenge Anytime you receive or find loose change in your […]

read more

Tax-Free Student Loan Forgiveness is Part of the Latest Covid-19 Relief Bill - Apr. 01, 2021

The recently passed American Rescue Plan (ARP) Act of 2021 includes a provision making nearly all student loan forgiveness tax-free, at least temporarily. Before the ARP, student loan forgiveness was tax-free only under special programs. Before we look at the changes to come under the ARP, let’s look back at what the previous law provided. […]

read more

The recently passed American Rescue Plan (ARP) Act of 2021 includes a provision making nearly all student loan forgiveness tax-free, at least temporarily. Before the ARP, student loan forgiveness was tax-free only under special programs. Before we look at the changes to come under the ARP, let’s look back at what the previous law provided. […]

read more

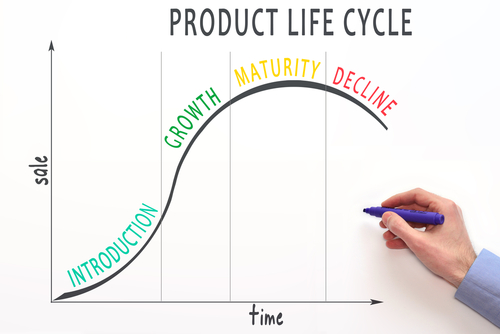

How Companies Can Become More Nimble During the Product Lifecycle - Apr. 01, 2021

The majority of U.S. industrial product company CFOs have shared concerns that COVID-19 would impact their businesses negatively. For companies that develop and manufacture products, understanding the product lifecycle and how to work around crises like the COVID-19 pandemic can be effective to help improve the longevity and success of companies. Market Development Stage According […]

read more

The majority of U.S. industrial product company CFOs have shared concerns that COVID-19 would impact their businesses negatively. For companies that develop and manufacture products, understanding the product lifecycle and how to work around crises like the COVID-19 pandemic can be effective to help improve the longevity and success of companies. Market Development Stage According […]

read more

Roth Conversion in 2021? - Apr. 01, 2021

In 2020, a year when all income brackets benefited from lower tax rates, the stock market took a nosedive at the beginning of the pandemic. For investors sharp enough to see the opportunity, this was an ideal time to convert a traditional IRA into a Roth IRA. When you conduct a Roth conversion, the assets […]

read more

In 2020, a year when all income brackets benefited from lower tax rates, the stock market took a nosedive at the beginning of the pandemic. For investors sharp enough to see the opportunity, this was an ideal time to convert a traditional IRA into a Roth IRA. When you conduct a Roth conversion, the assets […]

read more